Everything about Job Work Under GST

JOB WORK UNDER GST What is job work? Job work means processing or working on raw materials or semi-finished goods supplied by the principal manufacturer

JOB WORK UNDER GST What is job work? Job work means processing or working on raw materials or semi-finished goods supplied by the principal manufacturer

MARGIN SCHEME UNDER GST What is Margin Scheme? In the “Margin Scheme” taxpayers who are dealing in second-hand or used goods, may at his option,

CASUAL TAXABLE PERSON UNDER GST INTRODUCTION: Casual taxable person” means a person who occasionally undertakes transactions involving supply of goods or services or both

FILING FOR REGISTRATION BY PROVIDER OF OIDAR What are OIDAR Services? Online information and database access or retrieval services means services provided by the means

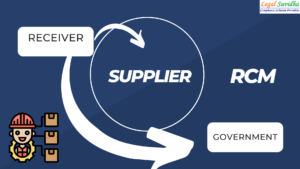

REVERSE CHARGE MECHANISM What is RCM under GST? The Reverse Charge Mechanism (RCM) is the process of GST Payment by the receiver instead of the supplier. In

GST RETURNS FOR E-COMMERCE OPERATORS AND SELLER What is E-Commerce? E-commerce refers to the purchase and sale of goods and/or services via electronic channels such

RULE 132 UNDER INCOME TAX AND THEIR IMPORTANCE The Central Board of Direct Taxes (CBDT) has introduced Rule 132, which came into effect on October

GST ADJUSTMENTS FOR THE F.Y 2021-22 The forms GSTR-1 and GSTR-3B returns which need to be filed in the month of November have been a

HOW TO FILE GSTR-9 FOR THE FY 2021-2022 What is the GSTR-9 annual return? GSTR 9 is an annual return to be filed yearly by

REPORTING OF 4-DIGIT HSN CODES IN GSTR-1 WITH TURNOVER UPTO RS.5 CRORE What is HSN Code? HSN stands for Harmonised System of Nomenclature code, it