A Detailed Analysis on Reverse Charge Mechanism

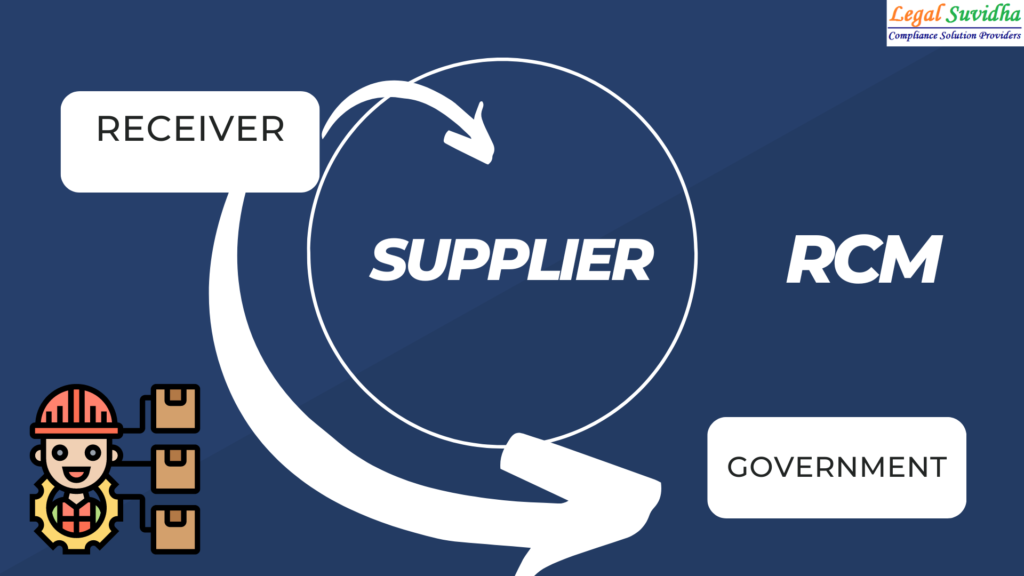

REVERSE CHARGE MECHANISM What is RCM under GST? The Reverse Charge Mechanism (RCM) is the process of GST Payment by the receiver instead of the supplier. In this case, the liability of tax payment is transferred to the recipient/receiver instead of the supplier. The Reverse Charge Mechanism is applicable in the case of : Imports Purchase from an unregistered […]

A Detailed Analysis on Reverse Charge Mechanism Read More »