REVERSE CHARGE MECHANISM

What is RCM under GST?

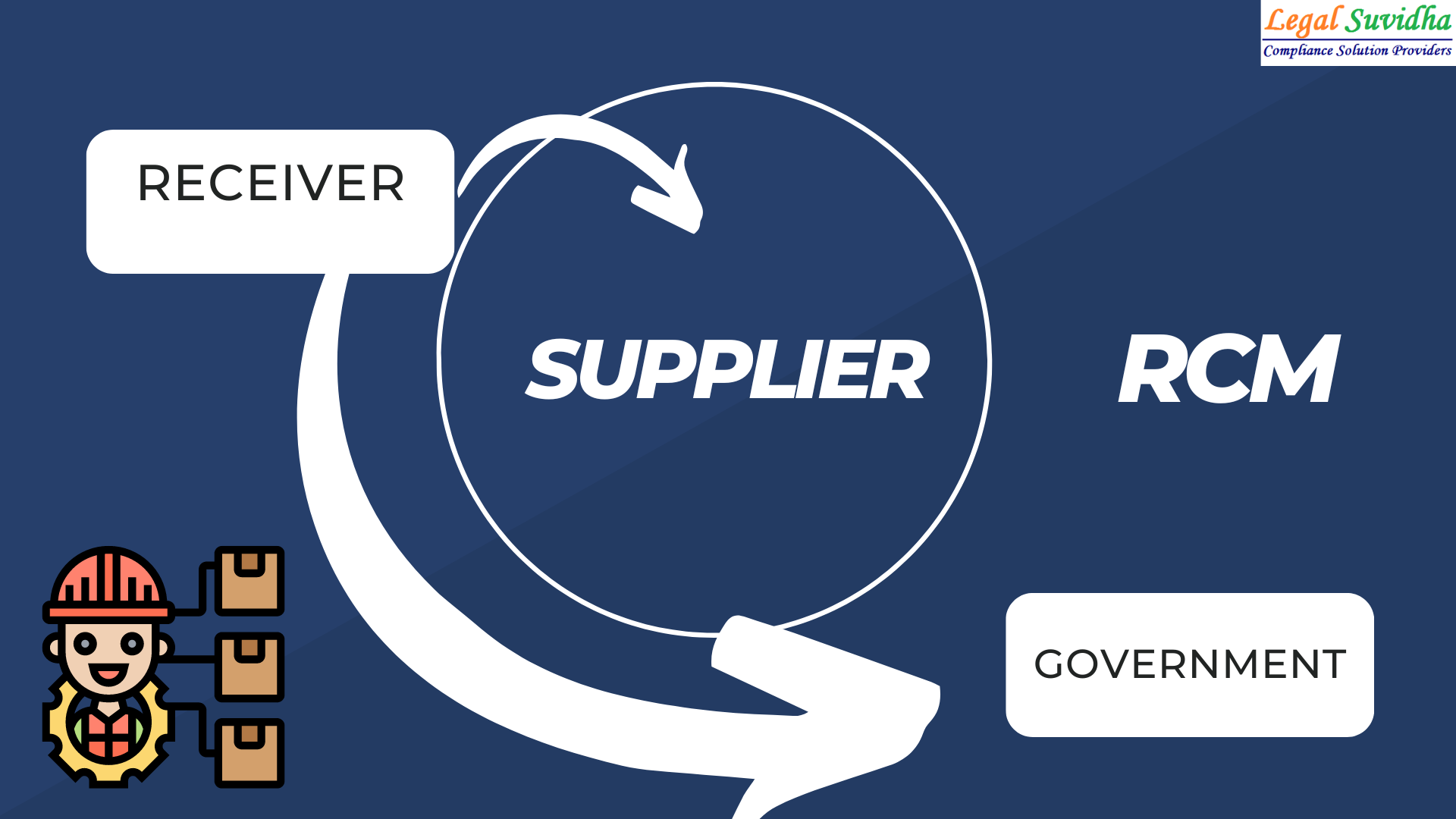

The Reverse Charge Mechanism (RCM) is the process of GST Payment by the receiver instead of the supplier. In this case, the liability of tax payment is transferred to the recipient/receiver instead of the supplier.

The Reverse Charge Mechanism is applicable in the case of :

- Imports

- Purchase from an unregistered dealer

- Supply of notified goods and services

This reverses the scenario as the person who is receiving the goods and services needs to pay the taxes. If the receiver is purchasing goods from unregistered providers, there needs to be a GST paid on their behalf. A payment voucher needs to be issued from the supplier to the recipient. The recipient must be a registered person as per Section 2(94) of the CGST Act,2017.

As per section 2(98) of CGST Act 2017, “Reverse-Charge” means the liability to pay tax by the recipient of the supply of goods or services or both instead of the supplier of such goods or services or both

- Under sub-section (3) or sub-section (4) of section 9, or

- Under sub-section (3) or subsection (4) of section 5 of the Integrated Goods and Services Tax Act

When is Reverse Charge Applicable?

Section 9(3), 9(4) and 9(5) of Central GST and State GST Acts govern the reverse charge scenarios for intrastate transactions. Also, sections 5(3), 5(4) and 5(5) of the Integrated GST Act govern the reverse charge scenarios for inter-state transactions. Let’s have a detailed discussion regarding these scenarios:

A. Supply of certain goods and services specified by the CBIC

As per the powers conferred in section 9(3) of CGST Acts, the CBIC has issued a list of goods and services on which reverse charge is applicable.

B. Supply from an unregistered dealer to a registered dealer

Section 9(4) of the CGST Act states that if a vendor is not registered under GST supplies goods to a person registered under BGST, then reverse charge would apply. This means that the GST will have to be paid directly by the receiver instead of the supplier. The registered buyer who has to pay GST under reverse charge has to do self-invoicing for the purchases made.

In intra-state purchases, CGST and SGST have to be paid under reverse charge mechanism (RCM) by the purchaser. Also, in the case of inter-state purchases, the buyer has to pay the IGST. The government notifies the list of goods or services on which this provision gets attracted from time to time.

In the real estate sector, the government notified that the promoter should buy inward supplies to the extent of 80% from registered suppliers only. Suppose the purchases from registered dealers shortfall 80%, then the promoter should GST at 18% on the reverse charge to the extent short of 80% of inward supplies. However, if the promoter purchases cement from an unregistered supplier, he must pay tax at 28%. This calculation is to be done irrespective of the 80% calculation.

The promoter is liable to pay GST on reverse charge basis on TDR or floor space index (FSI) supplied on or after 1st April 2019. Even if a landowner is not engaged in a regular business of land-related activities, transfer of development rights by such an individual to the promoter is liable to GST as it is considered as supply of service under section 7 of CGST Act. Also, in case of outward supply of TDR by one developer to another, GST is applicable at 18% on reverse charge.

C. Supply of services through an e-commerce operator

All types of businesses can use e-commerce operators as an aggregator to sell products or provide services. Section 9(5) of the CGST Act states that if a service provider uses an e-commerce operator to provide specified services, the reverse charge will apply to the e-commerce operator and he will be liable to pay GST. This section covers the services such as:

- Transportation services to passengers by a radio taxi, motor cab, maxi cab, and motorcycle. For example – Ola, and Uber.

- Providing accommodation services in hotels, inns, guest houses, clubs, campsites, or other commercial places meant for residential or lodging purposes, except where the person supplying such service through an electronic commerce operator is liable for registration due to turnover exceeding the threshold limit. For example – Oyo and MakeMyTrip.

- Housekeeping services, such as plumbing and carpentering, except where the person supplying such services through electronic commerce operators are liable for registration due to turnover beyond the threshold limit. For example, Urban Company provides the services of plumbers, electricians, teachers, beauticians etc. In this case, Urban Company is liable to pay GST and collect it from the customers instead of the registered service providers.

Time of Supply Under RCM

A. Time of supply in case of goods

In case of reverse charge, the time of supply for goods shall be the earliest of the following dates:

- the date of receipt of goods

- the date of payment*

- the date immediately after 30 days from the date of issue of an invoice by the supplier

Registration Rules Under RCM

Section 24 of the CGST Act, 2017 states that a person liable to pay GST under the reverse charge mechanism has to compulsorily register under GST. The threshold limits of Rs.20 lakh or Rs.40 lakh, as the case may be, will not apply to them.

Who Should Pay GST Under RCM?

The recipient of goods/services should pay GST under RCM. However, as per the provisions of GST law, the person supplying the goods must mention in the tax invoice whether tax is payable under RCM.

The following points should be kept in mind while making GST payments under RCM:

- The recipient of goods or services can avail of the ITC on the tax amount paid under RCM only if such goods or services are used for business or furtherance of business.

- A composition dealer should pay tax at the normal rates and not the composition rates while discharging liability under RCM. Also, they are ineligible to claim any input tax credit of tax paid.

- GST compensation cess can apply to the tax payable or pay under the RCM.

Input Tax Credit (ITC) Under RCM

A supplier cannot take the GST paid under the RCM as ITC. The recipient can avail of ITC on GST amount paid under RCM on receipt of goods or services, only if such goods or services are used or will be used for business purposes.

The recipient cannot use the ITC to pay output GST on goods or services under reverse charge and should be paid in cash only.

What is Self Invoicing?

Self-invoicing is to be done when purchased from an unregistered supplier, and such purchase of goods or services falls under reverse charge. This is because your supplier cannot issue a GST-compliant invoice to you, and thus you become liable to pay taxes on their behalf. Hence, self-invoicing, in this case, becomes necessary.

Also, section 31(3)(g) states that a recipient who is liable to pay tax under section 9(3) or 9(4) shall issue a payment voucher at the time of making payment to the supplier.